Unveiling the Landscape: A Comprehensive Guide to Licking County’s Tax Map

Related Articles: Unveiling the Landscape: A Comprehensive Guide to Licking County’s Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unveiling the Landscape: A Comprehensive Guide to Licking County’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Landscape: A Comprehensive Guide to Licking County’s Tax Map

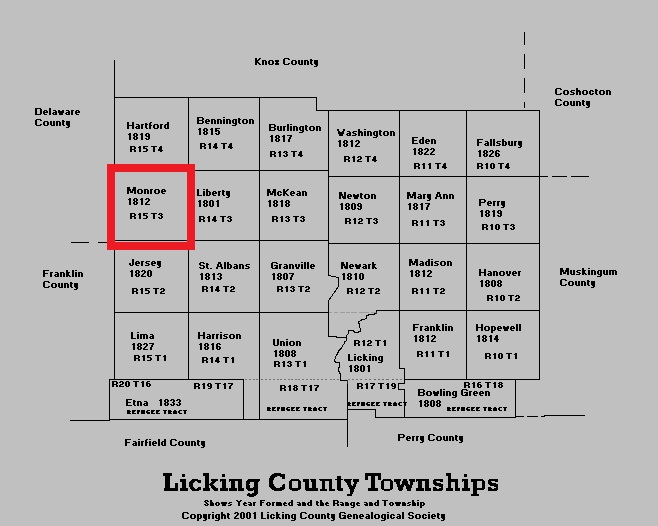

Licking County, Ohio, boasts a vibrant tapestry of communities, businesses, and natural landscapes. At the heart of understanding this diverse region lies the Licking County Tax Map, a crucial tool for navigating property ownership, development, and land management. This guide provides a comprehensive overview of the Licking County Tax Map, exploring its functionalities, importance, and benefits for various stakeholders.

Understanding the Licking County Tax Map: A Digital Blueprint

The Licking County Tax Map is a digitized representation of the county’s land parcels, providing a visual and informative platform for accessing key information about each property. It serves as a central repository for data related to:

- Property Ownership: The map clearly identifies the legal owner of each parcel, including their name, address, and contact information.

- Property Boundaries: Precise boundaries of each property are delineated, ensuring clear demarcation and minimizing potential disputes.

- Property Characteristics: Essential details like acreage, zoning classification, and any existing structures are readily available.

- Tax Assessments: The map displays current tax valuations, providing transparency and facilitating accurate property tax calculations.

- Development Status: Information regarding permits, approvals, and any ongoing construction projects is integrated into the map.

- Historical Data: The map often includes a historical record of ownership changes, transactions, and development activities.

Navigating the Licking County Tax Map: A User-Friendly Interface

Accessing the Licking County Tax Map is straightforward. The Licking County Auditor’s website provides a user-friendly interface with various search options:

- Address Search: Locate specific properties by entering their street address, ensuring accurate identification.

- Parcel Number Search: Utilizing the unique parcel number assigned to each property allows for precise identification.

- Owner Name Search: Searching by owner name provides a comprehensive list of properties under their ownership.

- Map-Based Exploration: The interactive map allows for visual navigation, enabling users to zoom in and out, pan across the county, and explore specific areas of interest.

The Importance of the Licking County Tax Map: A Foundation for Informed Decisions

The Licking County Tax Map plays a pivotal role in facilitating informed decisions across various sectors:

- Real Estate Professionals: Real estate agents, appraisers, and developers rely on the map for accurate property information, assisting in valuations, property identification, and market analysis.

- Property Owners: The map empowers property owners with clear insights into their property boundaries, tax assessments, and development regulations, enabling them to make informed decisions regarding their land.

- Government Agencies: The Licking County Auditor, Planning Department, and other agencies utilize the map for managing property records, assessing tax revenues, and implementing land use regulations.

- Public Access: The readily available map empowers citizens with information regarding their neighborhood, local development projects, and property ownership, fostering transparency and community engagement.

Benefits of the Licking County Tax Map: A Tool for Efficiency and Transparency

The Licking County Tax Map offers a multitude of benefits:

- Streamlined Property Transactions: The map facilitates accurate property identification, ensuring smooth and efficient real estate transactions.

- Accurate Tax Assessments: Clear property information enables the Licking County Auditor to conduct fair and equitable tax assessments, promoting transparency and accountability.

- Effective Land Management: The map assists in managing land use, enforcing zoning regulations, and ensuring sustainable development practices.

- Enhanced Community Planning: The map provides valuable data for urban planning, infrastructure development, and community growth initiatives.

- Increased Transparency and Accountability: The readily accessible map fosters transparency in property ownership, development activities, and tax assessments, enhancing public trust and accountability.

FAQs Regarding the Licking County Tax Map:

Q: How can I access the Licking County Tax Map?

A: The Licking County Tax Map is readily accessible on the Licking County Auditor’s website. Simply navigate to the website and locate the "Tax Map" or "Property Records" section.

Q: What information can I find on the Licking County Tax Map?

A: The map provides comprehensive information regarding property ownership, boundaries, characteristics, tax assessments, development status, and historical data.

Q: How can I use the Licking County Tax Map to find a specific property?

A: The map offers various search options, including address search, parcel number search, and owner name search. You can also explore the map visually using the interactive interface.

Q: Can I access the Licking County Tax Map on my mobile device?

A: Yes, the Licking County Auditor’s website is optimized for mobile devices, allowing you to access the map conveniently from your smartphone or tablet.

Q: Is the Licking County Tax Map updated regularly?

A: The Licking County Auditor’s office continuously updates the map to reflect changes in property ownership, boundaries, and development activities, ensuring its accuracy and reliability.

Tips for Utilizing the Licking County Tax Map:

- Familiarize yourself with the map’s interface: Explore the various search options and navigation tools to maximize your understanding of the map’s functionalities.

- Utilize the map for research: Conduct thorough research using the map’s comprehensive data before making any decisions regarding property ownership, development, or land management.

- Contact the Licking County Auditor’s office for assistance: If you encounter any difficulties or have specific questions regarding the map, do not hesitate to reach out to the Licking County Auditor’s office for assistance.

Conclusion: A Vital Resource for Licking County

The Licking County Tax Map serves as a vital resource for navigating property ownership, development, and land management. Its comprehensive data, user-friendly interface, and continuous updates empower various stakeholders with informed decisions, promoting transparency, accountability, and efficient resource utilization. By leveraging the Licking County Tax Map, individuals, businesses, and government agencies can effectively understand and manage the county’s diverse landscape, contributing to its continued growth and prosperity.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Landscape: A Comprehensive Guide to Licking County’s Tax Map. We thank you for taking the time to read this article. See you in our next article!