Understanding the Barrow County Tax Map: A Comprehensive Guide

Related Articles: Understanding the Barrow County Tax Map: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding the Barrow County Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Barrow County Tax Map: A Comprehensive Guide

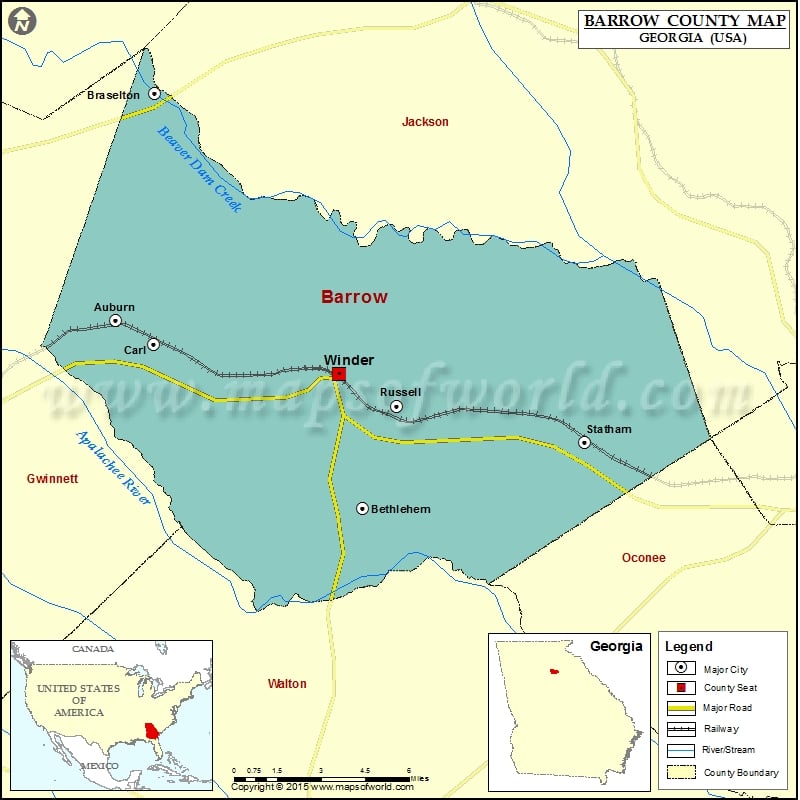

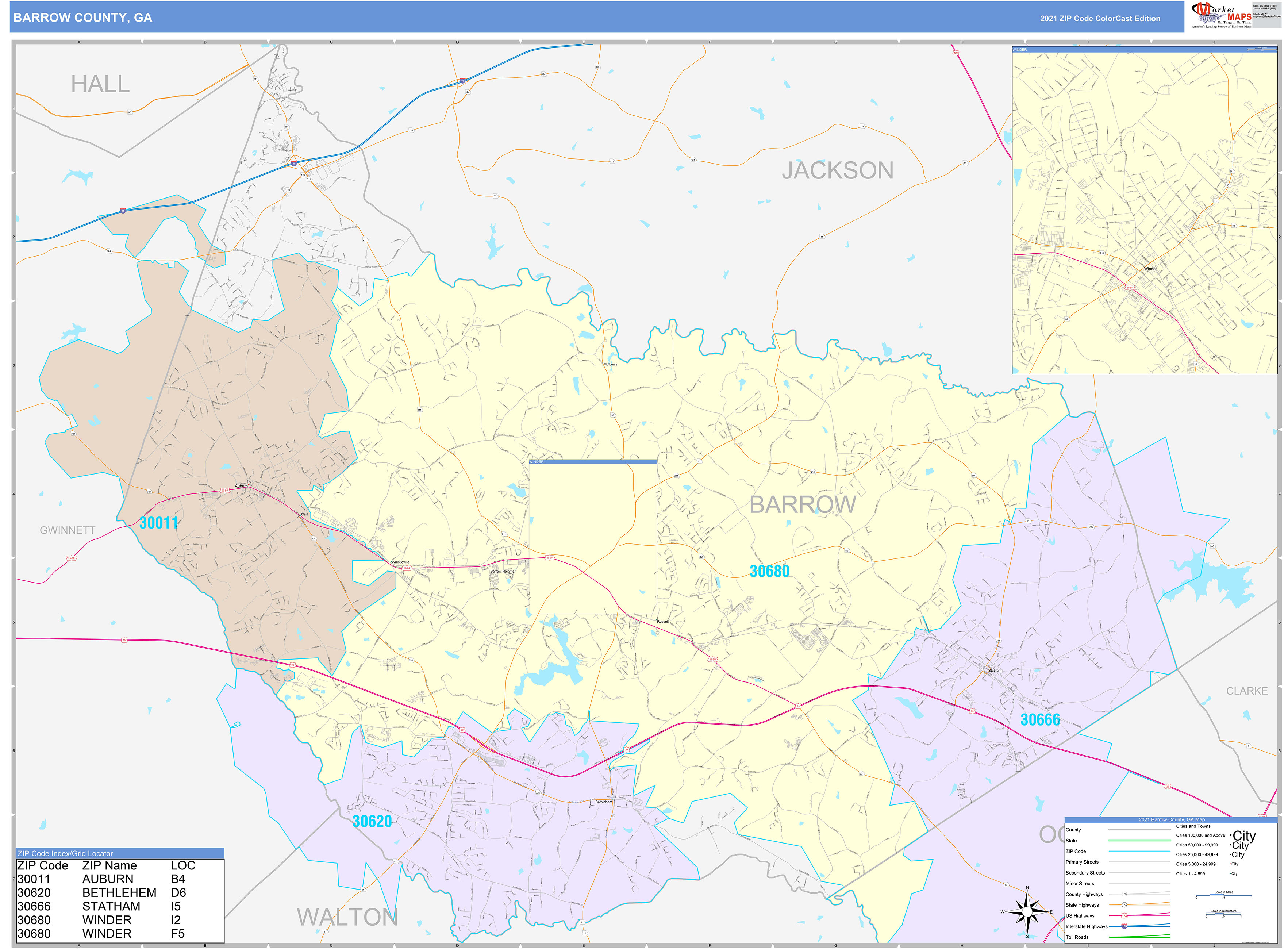

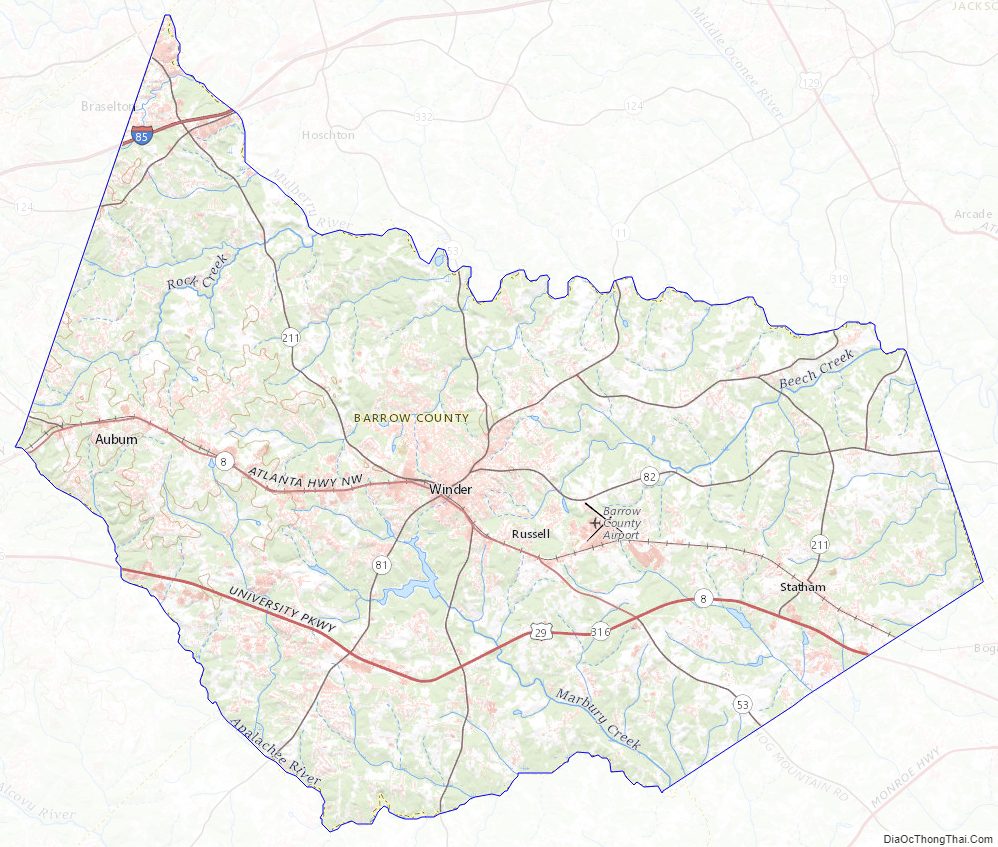

Barrow County, Georgia, like many other counties across the United States, maintains a detailed and comprehensive tax map. This map serves as a vital tool for both government officials and private citizens, offering valuable information regarding property ownership, assessment values, and tax liabilities.

What is a Tax Map?

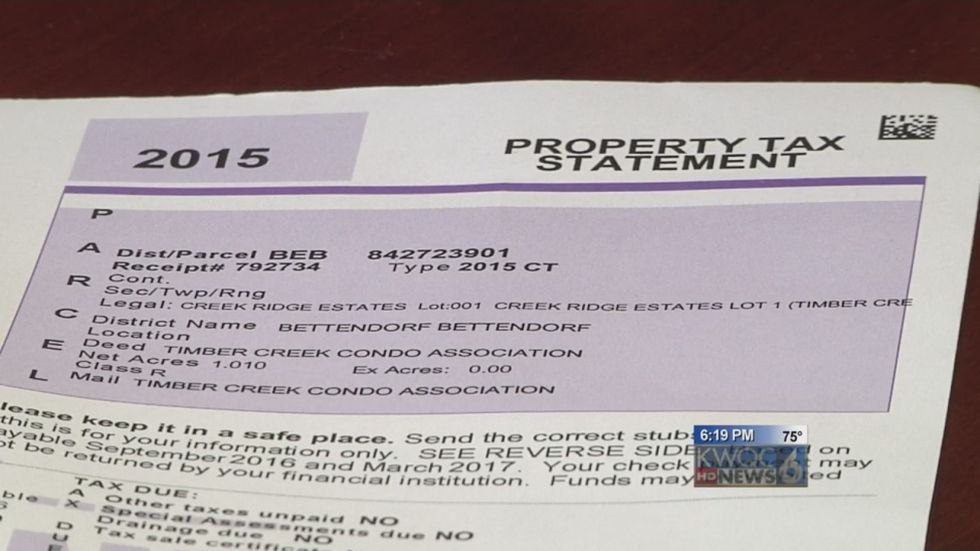

A tax map is a visual representation of a county’s real estate holdings, typically displayed on a grid system. Each property within the county is assigned a unique identifier, often referred to as a parcel number or tax ID. This number serves as the primary reference point for accessing detailed information about the property, including:

- Ownership: The names and contact information of the current property owner(s).

- Location: The precise geographical location of the property, including its address, boundaries, and acreage.

- Assessment: The estimated market value of the property, which forms the basis for property tax calculations.

- Tax Information: Details about the property’s tax liability, including the current tax rate and any outstanding balances.

Benefits of the Barrow County Tax Map

The Barrow County Tax Map provides a wide range of benefits for various stakeholders:

1. For Property Owners:

- Understanding Property Value: The map provides an accurate assessment of the property’s value, which can be helpful for planning real estate transactions, refinancing mortgages, or contesting property tax assessments.

- Property Identification: The map helps owners easily identify their property, its boundaries, and any adjacent properties.

- Tax Information Access: Owners can readily access information about their property taxes, including the current tax rate, due dates, and any outstanding balances.

2. For Real Estate Professionals:

- Property Research: Real estate agents and brokers can utilize the map to research properties, identify potential clients, and gather valuable information for property listings.

- Market Analysis: The map provides data on property values and ownership patterns, which can be helpful for conducting market analysis and identifying trends in the real estate market.

- Due Diligence: The map aids in conducting due diligence on properties, ensuring accurate information about ownership, liens, and other relevant factors.

3. For Government Officials:

- Tax Administration: The map facilitates efficient tax administration by providing a clear and organized record of property ownership and assessments.

- Property Management: The map helps government officials track property ownership changes, assess land use, and manage infrastructure development.

- Emergency Response: The map can be used for emergency response planning, providing vital information about property locations and access points.

4. For the General Public:

- Community Planning: The map provides insights into land use patterns and property development, which can be valuable for community planning and development projects.

- Historical Research: The map can be used for historical research, tracing property ownership and land use changes over time.

- Property Disputes: The map can help resolve property disputes by providing clear and accurate information about property boundaries and ownership.

Accessing the Barrow County Tax Map

The Barrow County Tax Map is typically accessible through the following avenues:

- Barrow County Tax Assessor’s Website: The Barrow County Tax Assessor’s website often provides an online interface for accessing the tax map, allowing users to search for specific properties by address, parcel number, or owner name.

- County Tax Assessor’s Office: The Barrow County Tax Assessor’s office will typically have physical copies of the tax map available for public inspection.

- Real Estate Websites: Several real estate websites, such as Zillow, Realtor.com, and Redfin, may integrate tax map data into their property listings.

Tips for Using the Barrow County Tax Map

- Familiarize Yourself with the Map Legend: Understand the symbols and abbreviations used on the map to accurately interpret the information.

- Utilize Search Functions: Most online tax maps provide search functions to quickly locate specific properties by address, parcel number, or owner name.

- Verify Information: Always verify the accuracy of the information displayed on the tax map by contacting the Barrow County Tax Assessor’s office if necessary.

- Consult with Professionals: For complex property transactions or legal disputes, it is advisable to consult with a real estate attorney or licensed appraiser.

FAQs about the Barrow County Tax Map

1. How do I find my property on the tax map?

You can typically search for your property by address, parcel number, or owner name on the Barrow County Tax Assessor’s website.

2. What information is included on the tax map?

The tax map typically includes information about property ownership, location, assessment value, and tax liability.

3. How often is the tax map updated?

The Barrow County Tax Map is generally updated annually to reflect changes in property ownership, assessments, and tax rates.

4. Can I use the tax map to contest my property tax assessment?

The tax map can provide valuable information for contesting a property tax assessment, but it is recommended to consult with a property tax attorney or appraiser for guidance.

5. Is the tax map available for free?

Access to the Barrow County Tax Map is typically free of charge, although some websites may offer premium features for a fee.

Conclusion

The Barrow County Tax Map serves as a crucial resource for understanding property ownership, assessment values, and tax liabilities. By providing a comprehensive and accessible visual representation of real estate holdings, the map empowers property owners, real estate professionals, government officials, and the general public with valuable information for making informed decisions related to property ownership, transactions, and community planning. As technology continues to advance, the Barrow County Tax Map is likely to become even more integrated with online platforms, providing greater convenience and accessibility for users.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Barrow County Tax Map: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!